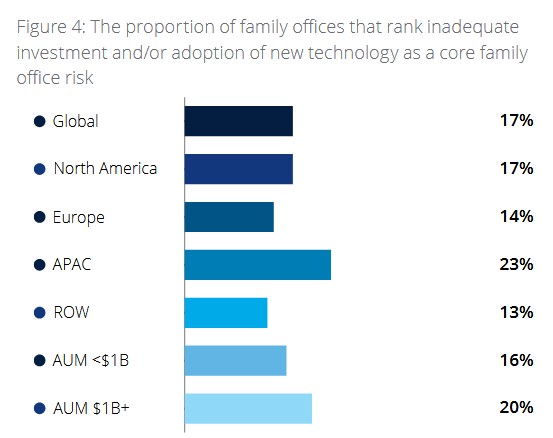

A Deloitte study of 354 family offices finds that while 43 per cent of them are developing or rolling out technology this year, one in five FOs say inadequate investment in technology is a “core” risk.

Further, almost three-quarters of respondents to the survey said they are underinvested or only moderately invested in the operational systems needed to run a modern business.

Source: Deloitte

At a time when family offices continue to mushroom around the world – Deloitte estimates that there will be more than 10,000 of these entities by the end of the decade, up from more than 8,000 at the start of 2024.

The latest edition of Deloitte Private’s Family Office Insights Series is entitled, Digital Transformation of Family Office Operations. It provides insights into family offices’ use of operational technology across their front, middle, and back-office functions.

At a time when cybersecurity threats are a major concern, the survey found that family offices’ top focus is on using technology to support their security and risk control processes.

Some 65 per cent claim moderate/extensive technology adoption, followed by technology to support their investment operations , investments , tax and wealth planning , and client management activities .

The most common types of technology family offices use are cloud-based applications/services , followed by virtual meetings , mobile communication apps , and identity and access management systems to safeguard one’s systems and data .

More than half of family offices now use data analytics to a moderate or large extent in their investments, while 42 per cent do so in their operations, to identify trends/patterns and support better quality decision-making.

AI is starting to make an impact. More than one in 10 family offices have begun to use AI-driven solutions to automate tasks, optimise portfolio management, enhance risk management, and more.

The families represented in the survey hold a total estimated wealth of $1.3 trillion, while the family offices have on average assets under management of $2.0 billion and total estimated AuM of more than $700 billion.